jana0183288630

About jana0183288630

Understanding Personal Loans For Bad Credit: A Comprehensive Guide

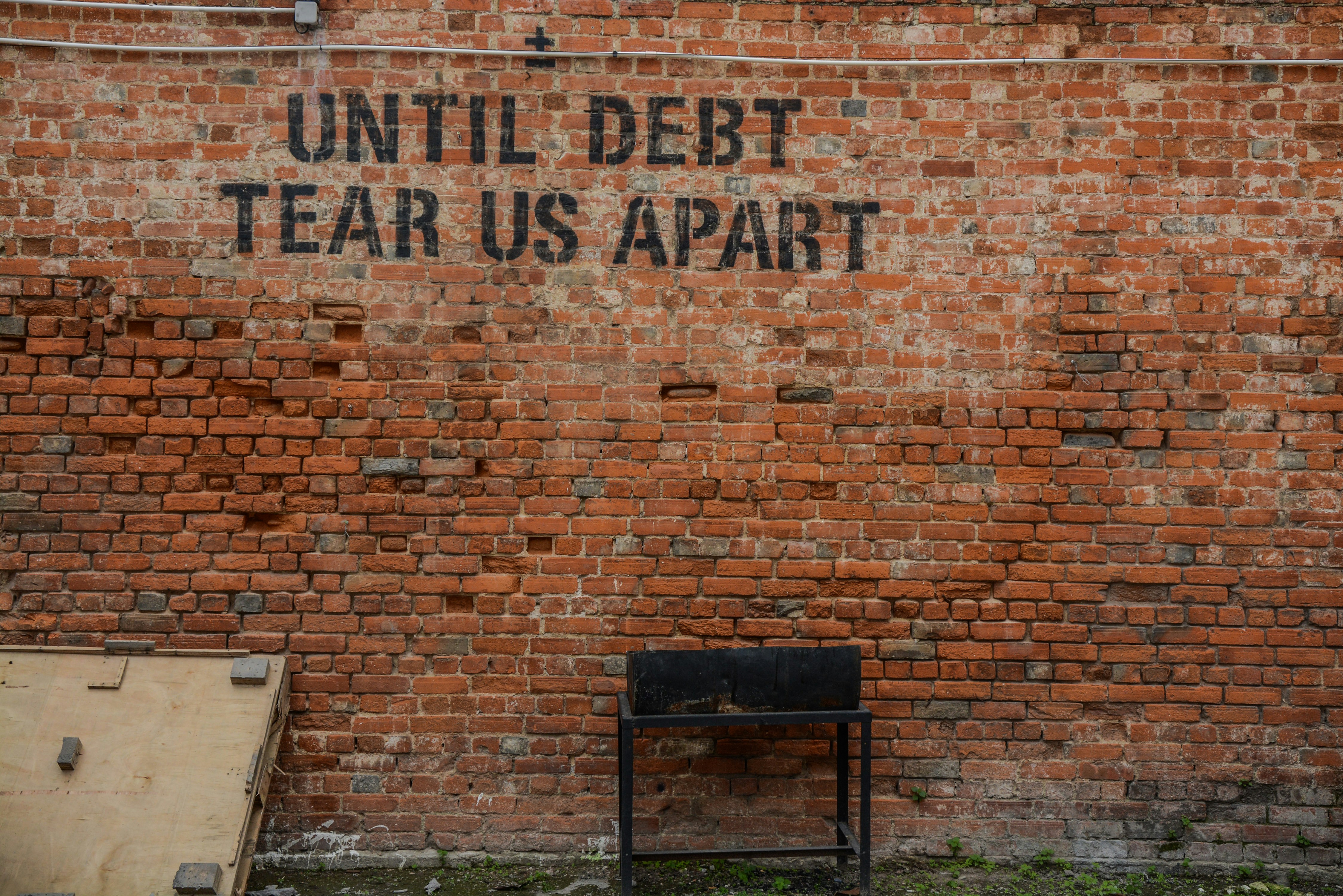

In today’s monetary landscape, personal loans have become a well-liked answer for individuals searching for to cowl unexpected expenses, consolidate debt, or finance significant purchases. If you beloved this post and you would like to get additional data regarding bad credit Personal loans kindly pay a visit to the web site. Nevertheless, for those with unhealthy credit score, securing a personal loan can really feel like an insurmountable challenge. This article aims to shed light on personal loans for bad credit, exploring the options obtainable, the implications of poor credit, and suggestions for enhancing your chances of approval.

What is Unhealthy Credit score?

Earlier than diving into personal loans for bad credit, it’s essential to grasp what constitutes dangerous credit. Credit scores sometimes vary from 300 to 850, with scores below 580 generally thought-about poor. Factors contributing to a low credit score score embrace missed payments, high credit score utilization, defaults, and bankruptcy. Dangerous credit can severely restrict an individual’s borrowing choices, leading to increased interest charges and stricter phrases.

Why Consider Personal Loans?

Despite the challenges related to bad credit, personal loans can provide several benefits:

- Debt Consolidation: If you have multiple debts with excessive-curiosity rates, a personal loan can assist consolidate them right into a single, more manageable cost. This can doubtlessly decrease your overall curiosity fee and simplify your finances.

- Emergency Bills: Unexpected expenses akin to medical bills, automotive repairs, or residence emergencies can come up at any time. Personal loans provide a fast technique to access funds when you want them most.

- Constructing Credit: Taking out a personal loan and making well timed funds may help improve your credit rating over time. This is particularly essential for individuals trying to rebuild their credit score historical past.

Kinds of Personal Loans for Bad Credit

When searching for a personal loan with dangerous credit, borrowers have several choices to think about:

- Secured Loans: These loans require collateral, such as a vehicle or financial savings account, which reduces the lender’s danger. Because of the collateral, secured loans often have lower interest rates than unsecured loans, making them a pretty possibility for those with dangerous credit.

- Unsecured Loans: Unsecured personal loans don’t require collateral, making them riskier for lenders. In consequence, they usually come with larger curiosity charges and stricter necessities. Nevertheless, they could be a viable choice for borrowers who wouldn’t have belongings to pledge.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper connect borrowers with individual investors willing to fund their loans. This various lending model can typically provide better phrases for these with dangerous credit compared to traditional banks.

- Credit Union Loans: Credit score unions are member-owned financial establishments that usually have extra flexible lending standards than conventional banks. If you’re a member of a credit score union, you might have access to personal loans tailor-made for people with bad credit.

- Payday Loans: While not really helpful attributable to their exorbitant interest rates and fees, payday loans are a final-resort option for individuals in dire monetary conditions. Borrowers needs to be cautious with this kind of loan, as it might probably result in a cycle of debt.

The applying Course of

Applying for a personal loan with unhealthy credit score involves a number of steps:

- Test Your Credit score Report: Before making use of for a loan, review your credit score report for errors and understand your credit score state of affairs. You can get hold of a free report from each of the three major credit bureaus once a year.

- Research Lenders: Not all lenders provide loans to individuals with unhealthy credit. Analysis varied lenders to find these specializing in bad credit score loans or have more lenient requirements.

- Collect Documentation: Lenders sometimes require documentation corresponding to proof of income, employment historical past, and identification. Having these documents prepared can streamline the applying course of.

- Prequalification: Some lenders can help you prequalify for a loan, supplying you with an idea of the phrases you might receive with out affecting your credit score rating. This step can make it easier to examine choices.

- Submit Your Application: As soon as you’ve chosen a lender, complete the application process. Be prepared to offer detailed details about your monetary state of affairs.

Understanding Interest Rates and Charges

Borrowers with unhealthy credit score ought to bear in mind that personal loans typically come with increased curiosity rates. The typical curiosity rate for personal loans can range significantly based on credit rating, lender, and loan amount. Additionally, borrowers should be cautious of hidden charges comparable to origination charges, late cost fees, and prepayment penalties. Always read the high quality print and ask the lender about any charges associated with the loan.

Enhancing Your Possibilities of Approval

While dangerous credit score may limit your options, there are steps you’ll be able to take to improve your probabilities of securing a personal loan:

- Improve Your Credit Rating: Take proactive steps to reinforce your credit score, equivalent to paying bills on time, reducing credit card balances, and disputing inaccuracies on your credit report.

- Consider a Co-Signer: When you’ve got a household member or friend with good credit willing to co-sign your loan, this may improve your chances of approval and potentially lower your interest rate.

- Show Stable Income: Lenders want to see that you’ve got a reliable source of earnings. Providing proof of regular employment can help exhibit your capacity to repay the loan.

- Limit Loan Quantity: Requesting a smaller loan quantity can enhance your possibilities of approval, as lenders may be extra willing to lend smaller sums to individuals with dangerous credit.

Conclusion

Navigating the world of personal loans with dangerous credit score can be daunting, but it is not unattainable. Understanding your options, researching lenders, and taking steps to enhance your credit score can result in successful loan approval. Remember to rigorously consider the terms and situations of any loan, and consider looking for financial recommendation if wanted. With persistence and diligence, you could find the financial support you need, even with a less-than-excellent credit historical past.

No listing found.