jeanninecopela

About jeanninecopela

Understanding IRA Gold Accounts: A Comprehensive Overview

Individual Retirement Accounts (IRAs) have lengthy been a staple for people seeking to safe their monetary future. Among the assorted types of IRAs out there, the Gold IRA has gained vital consideration in recent years. This report goals to supply a detailed overview of IRA gold accounts, including their structure, benefits, dangers, and steps to ascertain one.

What is a Gold IRA?

A Gold IRA is a sort of self-directed Individual Retirement Account that allows traders to hold bodily gold and different treasured metals as part of their retirement portfolio. In contrast to conventional IRAs that usually hold stocks, bonds, and mutual funds, Gold IRAs allow individuals to invest in tangible assets, which might act as a hedge against inflation and financial downturns.

Types of Valuable Metals Allowed

While the identify suggests a concentrate on gold, Gold IRAs can include a variety of precious metals. The IRS permits the inclusion of the following in a Gold IRA:

- Gold bullion and coins

- Silver bullion and coins

- Platinum bullion and coins

- Palladium bullion and coins

Nonetheless, not all gold and silver merchandise qualify. To be eligible for a Gold IRA, the metals should meet specific purity requirements set by the IRS. As an illustration, gold will need to have a purity of 99.5% or greater, while silver must be 99.9% pure.

Advantages of Gold IRAs

- Inflation Hedge: Gold has traditionally been seen as a protected-haven asset. During intervals of excessive inflation or financial instability, gold tends to retain its value, making it a pretty choice for buyers wanting to protect their purchasing energy.

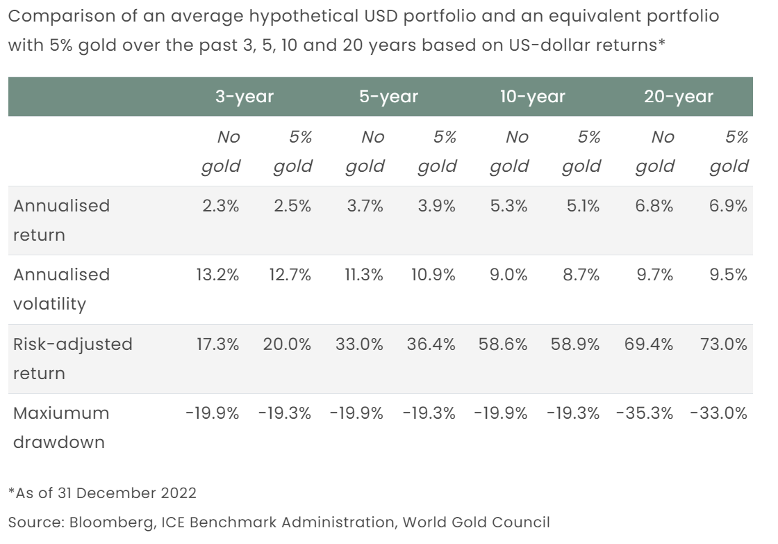

- Portfolio Diversification: Together with gold in an investment portfolio can provide diversification. Gold often moves independently of stocks and bonds, which can help mitigate danger throughout market volatility.

- Tax Advantages: Like traditional IRAs, Gold IRAs supply tax-deferred progress. Because of this traders don’t pay taxes on their positive aspects until they withdraw funds in retirement, doubtlessly lowering their total tax burden.

- Physical Possession: Unlike paper assets, a Gold IRA permits traders to personal bodily gold. This can present a way of safety, as tangible assets will not be topic to the same risks as digital or paper investments.

Dangers and Issues

Whereas Gold IRAs offer several benefits, additionally they include dangers and concerns that potential buyers ought to bear in mind of:

- Market Volatility: The worth of gold can be highly volatile. Whereas it might act as a hedge in opposition to inflation, there are durations when gold costs can decline significantly, impacting the general value of the investment.

- Charges and Expenses: Establishing a Gold IRA can contain various fees, including setup charges, storage charges, and administration fees. These costs can eat into investment returns, so it’s important to know the fee structure before proceeding.

- Limited Liquidity: Promoting bodily gold can be much less easy than liquidating stocks or bonds. Traders might face challenges find consumers or could must promote at a low cost, particularly in a down market.

- Regulatory Compliance: Gold IRAs must comply with IRS regulations, together with the sorts of metals that can be held and how they’re stored. Failure to adhere to these rules may end up in penalties and taxes.

The way to Arrange a Gold IRA

Organising a Gold IRA includes a number of steps:

- Choose a Custodian: The first step is to select a custodian who makes a speciality of Gold IRAs. The custodian is responsible for managing the account, ensuring compliance with IRS rules, and facilitating the purchase and storage of precious metals.

- Fund the Account: Investors can fund a Gold IRA by way of varied means, including transferring funds from an current retirement account (like a 401(okay) or traditional IRA) or making a direct contribution. It’s crucial to understand the contribution limits and tax implications of every funding method.

- Select Valuable Metals: Once the account is funded, investors can select which valuable metals to buy. This decision must be primarily based on individual investment targets, market conditions, and the specific metals’ potential for appreciation.

- Storage Options: The IRS requires that bodily gold held in a Gold IRA be stored in an accepted depository. Investors cannot take possession of the metals until they withdraw from the account. Custodians sometimes have partnerships with safe storage facilities.

- Monitor and Handle: After establishing the account and buying metals, it’s essential to observe the funding repeatedly. This includes preserving monitor of market trends, understanding the performance of the metals held, and making changes as needed.

Conclusion

IRA gold accounts provide a unique alternative for investors trying to diversify their retirement portfolios and hedge against financial uncertainty. While they include particular advantages, resembling tax benefits and the potential for lengthy-term worth retention, in addition they carry dangers and prices that should be fastidiously considered. If you adored this post and you would certainly like to receive more details pertaining to affordable options for gold ira rollover kindly go to the web-site. By understanding the structure of Gold IRAs and following the mandatory steps to ascertain one, investors can make knowledgeable decisions that align with their retirement objectives. As with all investment, it is advisable to conduct thorough research and seek the advice of with financial professionals to ensure that a Gold IRA is the proper choice for individual circumstances.

No listing found.